Click here to view the December newsletter

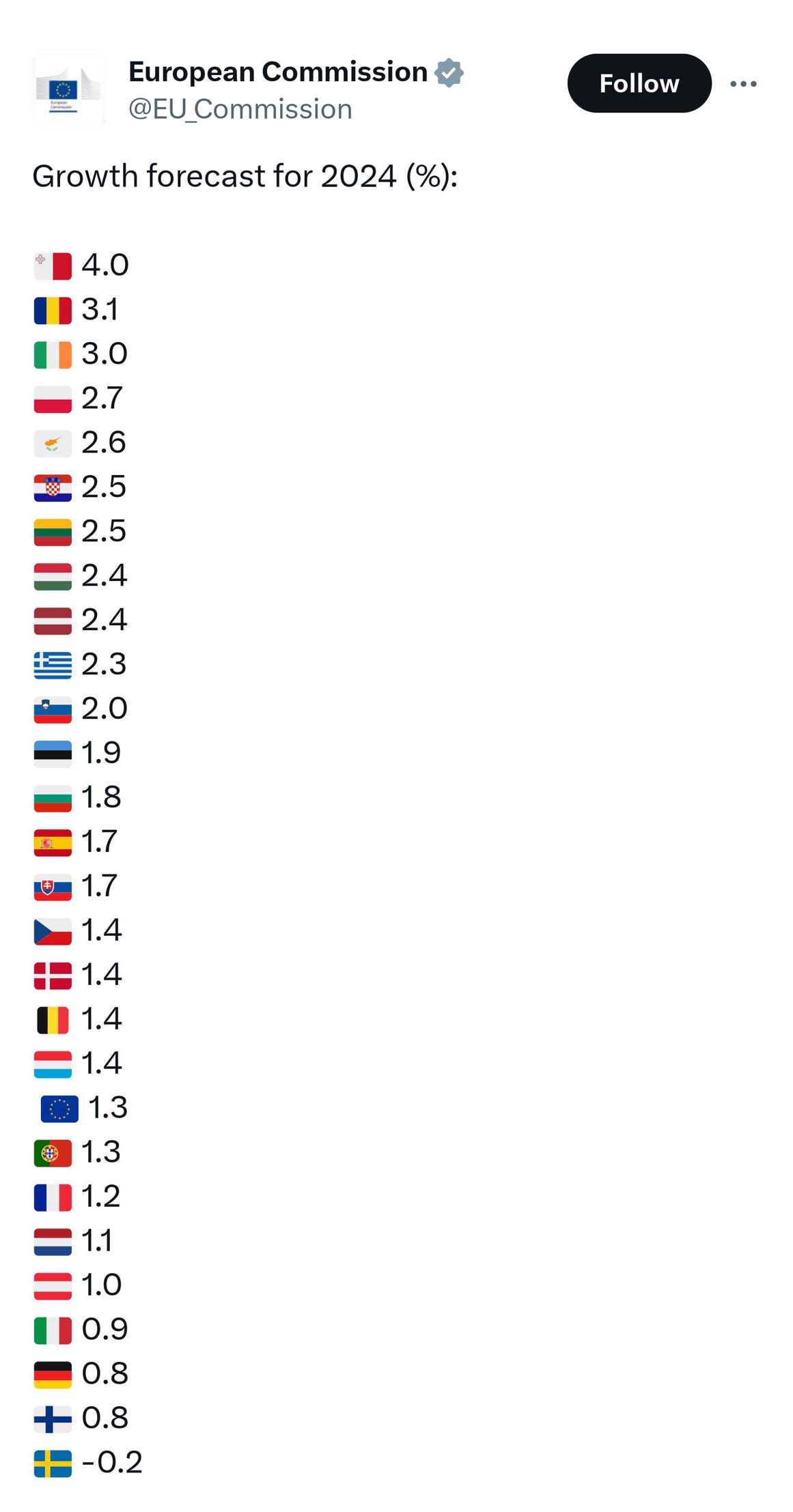

The European Commission has predicted that Malta will experience the highest economic growth among EU countries in 2024. Malta’s GDP growth is projected to reach 4.0% this year, falling slightly to 4% next year. Additionally, the Budget forecasted a 4.2% growth rate for 2024.

INTERNATIONAL TAXATION

Malta has opted to delay the EU Minimum Tax Directive, which would have introduced a 15% minimum tax on multinational groups with annual revenues of €750 million or more.

The three components of the Pillar 2 Rules – the Income Inclusion Rule, the Undertaxed Profit Rule, and the Qualified Domestic Minimum Tax – will not be introduced in 2024, and there will be no top-up tax in Malta.

To maintain its competitiveness on an international level, Malta is developing measures and incentives, such as grants and refundable tax credits, that are in line with EU and OECD regulations. The current full imputation tax system will remain in place.

BUSINESS

- Discussions are ongoing with banks to ensure that all traders have access to a basic bank account.

- The Common Central Data Repository is being established to streamline the identification process for businesses operating in Malta, thus avoiding duplicate requests for information by multiple regulatory bodies.

- A new Malta Business Registry portal will be launched, enabling electronic submission of documents with a secure digital signature.

- Malta Enterprise will work towards the creation of a Competence Centre in the semiconductors and microchips industry to attract investment and promote growth in the sector.

- The gaming industry’s regulatory framework will be strengthened, and the implementation of the esports strategy will continue.

- The MFSA is expected to make regulatory changes, including amendments to Limited Partnerships rules. Details to follow.

- Inter vivos transfers of company shares remain subject to a reduced rate of 1.5% on the real value.

- Family businesses registered with the Family Business Office are eligible for a higher tax credit cap on their investment.

Click here to view the December newsletter