Click here to view the January newsletter

Recap of the general overview, that you read last month:

Tax certificates for Malta companies can be obtained from the Maltese tax authorities. These certificates provide information about the tax status and compliance of a company in Malta and may include details such as the company’s tax registration number, address, and confirm Malta as a country of tax residency of your company.

To obtain a tax certificate, you will typically need to have no outstanding tax liabilities and submit a request to Malta tax authority via your local corporate service provider.

There are two types of TRCs in Malta:

- TRC stating that the Company is registered in Malta, its registered address and international tax number (let’s call it “General” for ease of reference)

- TRC that declares that the Company is resident in Malta for avoidance of double taxation between Malta and the other country (we have named it “Tax Treaty” for your convenience).

As your trusted advisers, it’s our job to curate the complexities by simplifying and clarifying such matters. Let’s dive into each type of TRC and see how your business will benefit from it:

TAX RESIDENCY CERTIFICATE, GENERAL

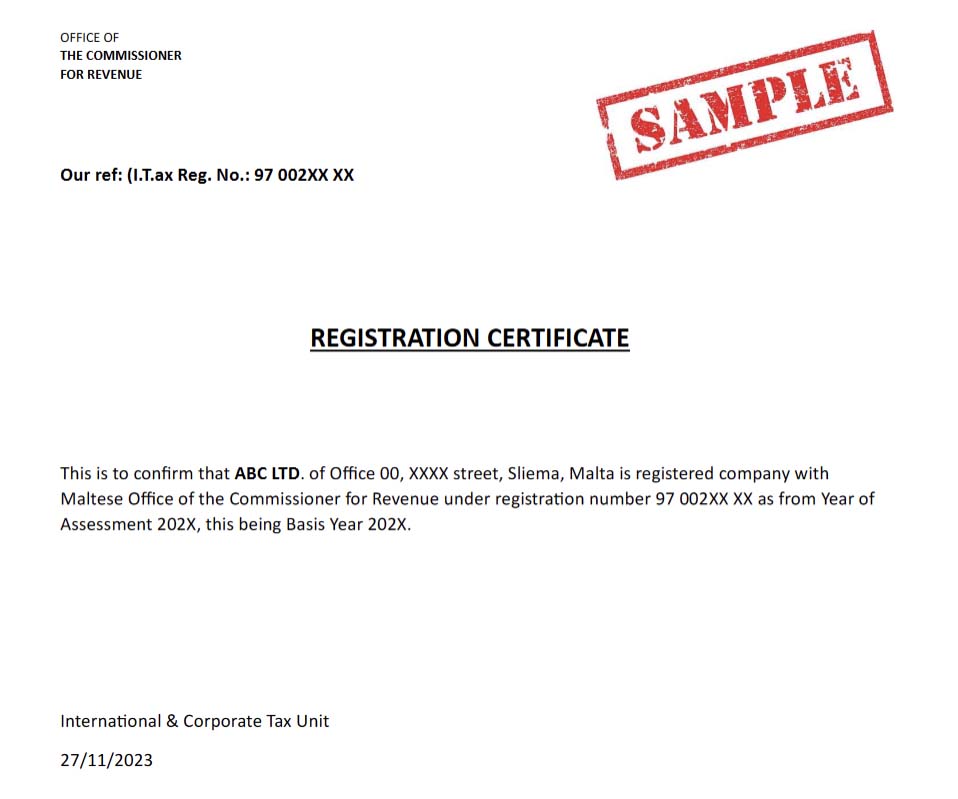

As you may see from the sample, it shows only general information of the Company: it’s registered address, local tax number etc.

This type of certificate is issued when you need to prove your Company’s tax residency for a bank account opening or for execution of international business transaction, for example.

Banks often request a tax residency certificate from a company for several reasons:

- Determination of Taxation: A tax residency certificate helps banks and e-Money institutions ascertain where a company is primarily liable to pay taxes. This information is crucial for the bank’s compliance and reporting purposes.

- Taxation on Income: Banks and EMIs might use this certificate to determine the tax treatment of income generated from various sources for that company. For instance, interest earned on deposits or dividends received might have different tax implications based on the tax residency status, and applicable tax treaties.

- Anti-Money Laundering (AML) Regulations: Banks have stringent AML policies in place. Confirming a company’s tax residency status through official documentation like a tax residency certificate helps banks ensure compliance with regulations and prevent financial or fiscal crimes.

- Credit or Loan Assessment: For credit facilities or loans, banks might consider a company’s tax residency status as part of their risk assessment and lending criteria.

In summary, requesting a tax residency certificate is a standard practice for banks to ensure compliance, understand tax implications, and appropriately handle financial transactions with companies, especially those operating across borders or involved in international activities.

General tax residency certificate might also become handy when you enter international deals. Your counter-side or a contracting party might ask for a proof of your Company’s tax residency. Understanding the tax residency of the company is crucial, especially if it involves cross-border transactions.

Here’s why a business partner partner might request a tax residency certificate from your company:

- Documentation for Transactions: For various business transactions or contracts, especially those involving financial agreements or joint ventures, partners might require a tax residency certificate as part of their documentation and due diligence process.

- Risk Assessment: Understanding the tax residency status of a partner company can be part of a risk assessment process. It helps in evaluating the potential risks associated with tax obligations and compliance, especially in international business relationships.

In essence, requesting a tax residency certificate is a way for international deals to ensure clarity on tax obligations, compliance with laws, and potential benefits or implications regarding taxation when engaging in business relationships with other companies.

TAX RESIDENCY CERTIFICATE, TAX TREATY

Malta has tax treaties with various countries to avoid double taxation and prevent tax evasion.

These treaties typically outline how income earned in one country by a resident of another country is taxed.

They also cover areas like withholding taxes, tax rates on different types of income (such as dividends, interest, capital gains and royalties), and procedures for resolving tax disputes between the two countries.

Malta has a network of double taxation treaties with numerous countries, including but not limited to the United Kingdom, the United States, Canada, Italy, France, Germany, and many others.

These treaties aim to foster economic cooperation and investment between Malta and its treaty partners while providing clarity on tax obligations for individuals and businesses operating internationally.

If you’re considering business or investment activities between Malta and another country, it’s essential to review the specific tax treaty between jurisdictions.

Potential scenario of dual tax residency:

If you run your company from a foreign country outside Malta, Malta Permanent Establishment or Malta Branch of your foreign country, your company might have tax residency in that foreign country. In this case, your Malta company has dual tax residency. This happens when two states believe that the company is a tax resident in their jurisdiction, and both will want to tax your company’s profits, and profit distributions.

If you aim to take full advantage of the Maltese corporate tax system, this is a situation you likely want to avoid. Here Tax Residency certificate, issued specifically for another country, steps in:

This type of TRC states that the Company has full right to benefit from a tax treaty between e.g., Malta and Czech Authorities – as you may see from the sample. Another country, where this certificate is requested from – obligatory to state when applying for TRC.

Banks and E-money institutions could also require this type of tax residency certificate as part of compliance with tax treaties. In cases where a company operates internationally, especially in countries with which Malta has a tax treaty, the tax residency certificate becomes vital. It helps in availing treaty benefits, such as reduced withholding tax rates on certain types of income. It is important to understand that tax treaties do not impose any taxes. Tax treaties reduce taxes, eliminate taxes applying exemptions or avoid double taxation.

1step is happy to assist you in navigating the complexities of international taxation and advise you on corporate tax planning matters. We can help you to establish substance requirements in Malta maintaining as well as supporting you to sustain Maltese corporate tax residency for your company.

Why 1step?

International tax planning requires knowledge of local and international laws and regulations. This is a competence that we have curated over many years in business.

Our expert team has many years of combined experience in understanding the specifics of local and international laws, and regulations.

Malta has a wonderful and unique corporate tax system and we know how to ensure it works best for you, and how the country can be best utilised for efficient corporate structuring to your benefit.

Click here to view the January newsletter