Click here to view the June newsletter

Malta’s tax system has some smart features, and one of the most useful – especially for international business groups – is the Fiscal Unit regime, introduced back in 2020. If your business has both active operations and investment income, you can structure your companies to make the most of Malta’s tax rules. Here’s how it works.

The Big Idea

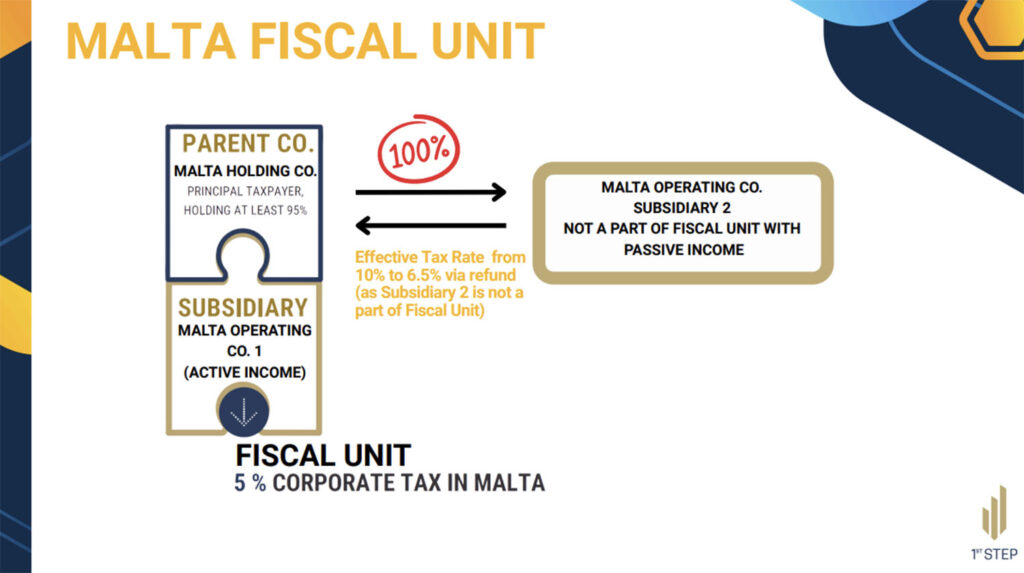

The Fiscal Unit regime lets a group of Maltese companies – where one owns at least 95% of the others – file as a single taxpayer. That means one tax return, one group tax rate, and a simpler setup overall. But the real trick? Knowing which companies should be in the unit, and which should stay out.

What the Setup Looks Like

A typical structure has three companies:

- Malta Holding Company

The main holding entity. It acts as the “Principal Taxpayer” and files the tax return for the whole Fiscal Unit. - Malta Operating Co. 1 (Active Income)

This company runs the business – sells, trades, provides services, etc. It’s part of the Fiscal Unit and taxed at a reduced rate. - Malta Subsidiary 2 (Passive Income)

This company earns from things like royalties, dividends, or interest. It stays outside the Fiscal Unit for good reason (we’ll explain below).

Why Use the Fiscal Unit?

Within the Fiscal Unit, your group’s profits are taxed at an effective 5% rate, right up front – no need to wait for tax refunds like in the regular Maltese tax system. That means:

- Fewer admin headaches

- Better cash flow

- Lower tax bill on your active income

Important: You don’t get any refunds inside the unit – just the direct 5% rate.

So Why Keep a Company Outside the Unit?

Your passive income company (Subsidiary 2) stays out because passive income like dividends and interest doesn’t qualify for the Fiscal Unit’s 5% rate. But here’s the good news: under Malta’s normal tax system (35% corporate tax), foreign shareholders can claim tax refunds. Depending on the type of income, these refunds often bring the effective tax rate down to around 6.5 – 10%.

So basically:

- Active income? Put it in the Fiscal Unit. Pay 5% tax directly.

- Passive income? Keep it out. Use refunds to lower the final tax.

Why This Structure Works

By splitting up the companies like this, you get the best of both worlds:

- Simplified taxes and low upfront rates on business income

- Access to Malta’s refund system and treaties for passive/investment income

It’s a smart, flexible approach that helps international groups minimize tax legally and efficiently – and it keeps your structure clean and compliant.

Malta’s Fiscal Unit regime is a powerful tool – but only when it’s used right. With the right setup, you can streamline tax filings, reduce your effective rates, and separate your income types in a way that really works for you.

Want help structuring your group for maximum efficiency? Get in touch – we’re happy to walk you through the options.

Click here to view the June newsletter